Uncorrelated risk

What makes Ample truly new

Ample is an elastic-supply base-money

696.69MM total supply of Ample (+138% vs last week)

Unique movement patterns

Each week, we answer a burning question from the community. Ample, DeFi, money and macroeconomics are all fair game here on Rebase. Join us on Twitter and Discord to participate and your question might get featured.

Last week, we asked What is rebase? and explored how Ample translates volatility from price to supply through a daily mechanism that increases or decreases Ample held in user wallets based on the difference between the Ample oracle rate and its target price, which is tracked in real-time on the Ampleforth dashboard.

This week, we ask: Why might Ample be uncorrelated to anything else?

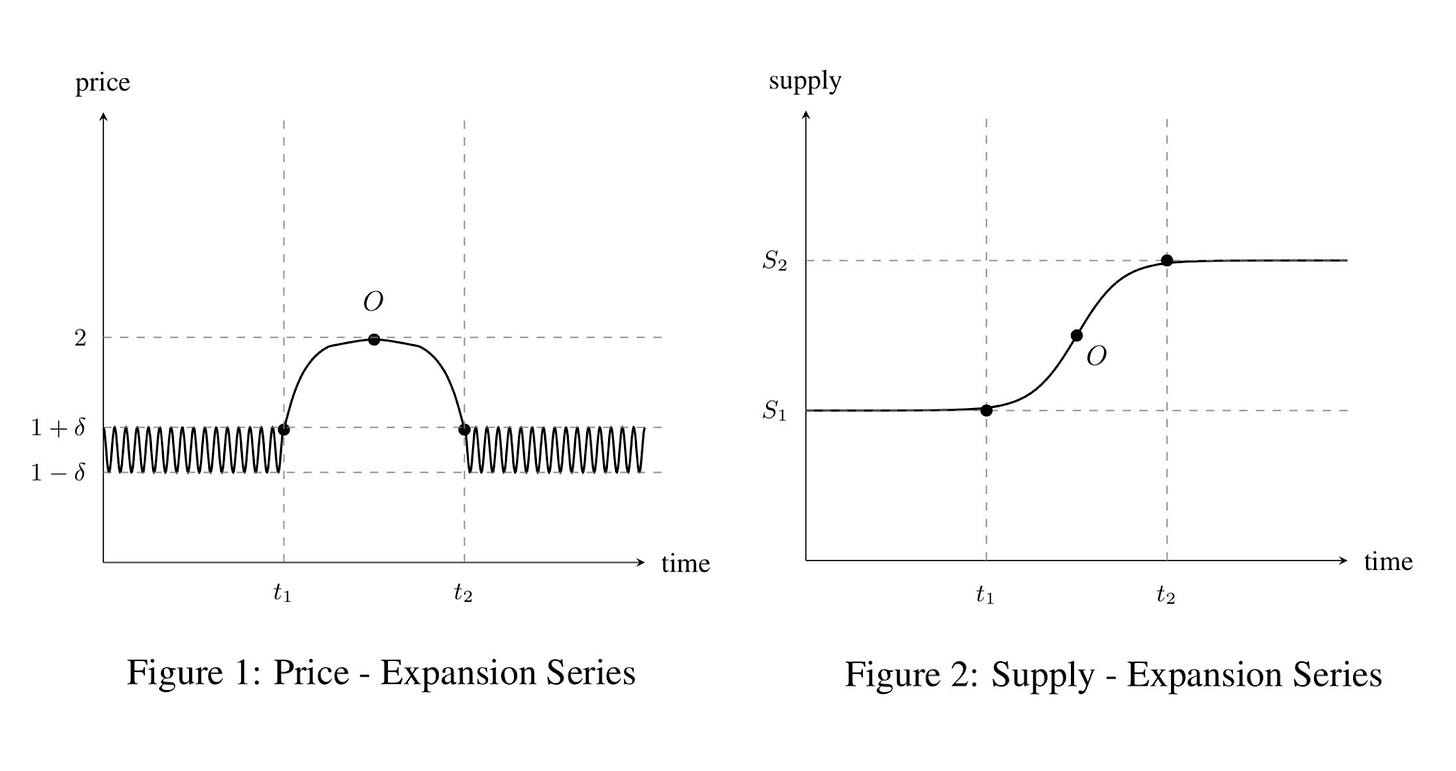

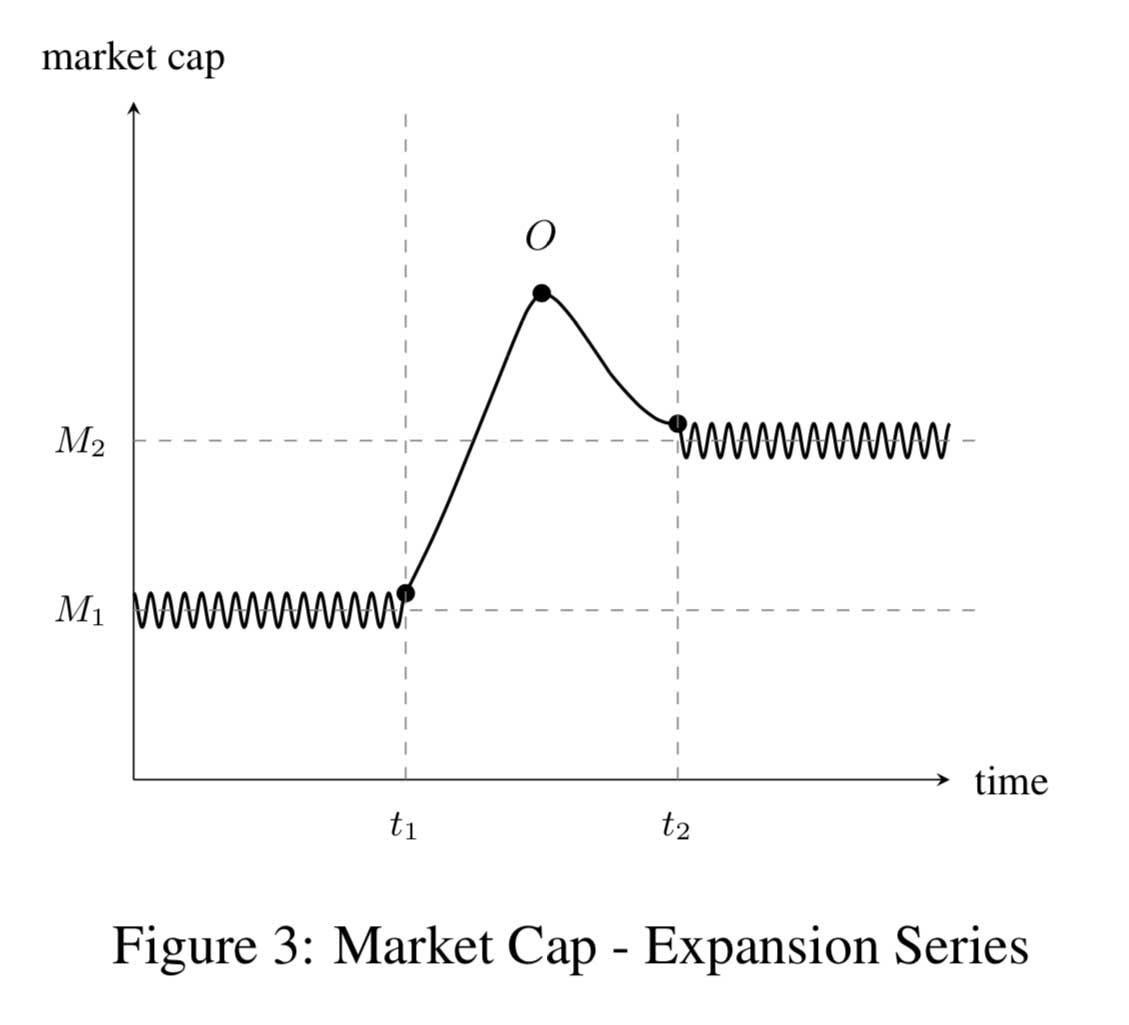

Ample’s elastic supply policy produces unique movement patterns over time across price, supply and market cap. Here’s an expansionary example from the Ampleforth Red Book:

In this sense, Ample is volatile by design, and as a result, decoupled from existing digital assets. Not only does this allow investors to add diversity to their portfolio, but the supply elasticity itself can prevent liquidity crunches as well.

In simple terms, Ample is a new base-money collateral asset that offers investors more liquidity and more risk optionality in their never-ending search for yield.

What is a base-money collateral asset, and why does it matter for DeFi?

DeFi is exploding. Thanks in part to projects like Maker, Compound, Synthetix, Aave and Uniswap, total value locked (TVL) is now $3.64 billion, up more than 5X from $692 million at the start of this year. The sophistication of different lending and liquidity protocols matched with improving UX is bringing in thousands of new users, all of whom are looking for one thing. Yield.

But there’s a problem lurking underneath DeFi. Base-money collateral assets like BTC and ETH are not only highly correlated but also subject to liquidity crunches due to their inelastic supply. This is what caused DeFi investors so much pain on Black Thursday. Without a new base-money collateral asset that offers uncorrelated risk and perfect supply-elasticity, systemic risks will continue to loom large over the entire DeFi market.

Ample is a new base-money collateral asset for DeFi that’s uncorrelated with BTC, ETH or anything else because of the unique movement patterns brought on by its elastic supply policy.

Read why Ample offers DeFi something new.

Ample in the news

CoinDesk: This DeFi-Ready Token Is Teaching Crypto Traders to Cherish Inflation

[Ampleforth] decided to tackle a problem in digital-asset markets: tight correlations between bitcoin and alternative cryptocurrencies that make the market vulnerable to widespread sell-offs – as traders scramble for cash or cash-like instruments such as dollar-backed stablecoins.

The project aims to address the systemic risk by designing a token to be mostly uncorrelated with other cryptocurrencies, and also isolated from swings in traditional financial markets.

Bankless x Ampleforth: Interview with Ampleforth Co-founder Brandon Iles

Recommended reading

This week’s recommended reading is “DeFi Needs Better Primitives” by Ampleforth co-founder Evan Kuo from earlier this year.

At a high level, decentralized banks like MakerDAO can be viewed as directionally reducing the role of centralized banks. We felt—along similar lines—it was time to gently expand the role of base-monies. The AMPL does not have a balance-sheet, it does not retake custody of tokens or airdrop new tokens to adjust supply—and no, it’s not a stablecoin—at least not by the use-cases assigned to the role of stablecoins today.It is a new decentralized base-money.

We’ll be discussing base-money collateral assets on Twitter and Discord this week, so be sure to read and join in.

Share Ampleforth

Try explaining Ample to your friends. We’d love to hear your feedback and ideas to make it simpler to understand and more fun to discuss!

See you at the next rebase!